Manufacturing Overhead Applied to Production Is Always Recorded on the

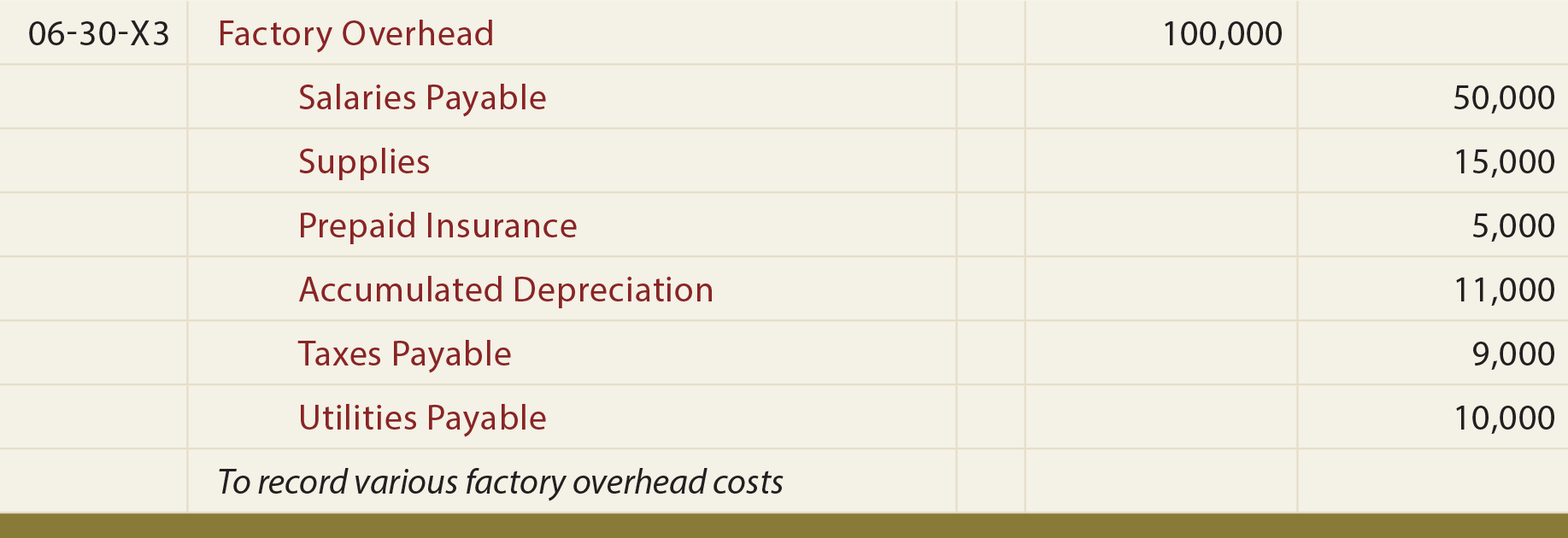

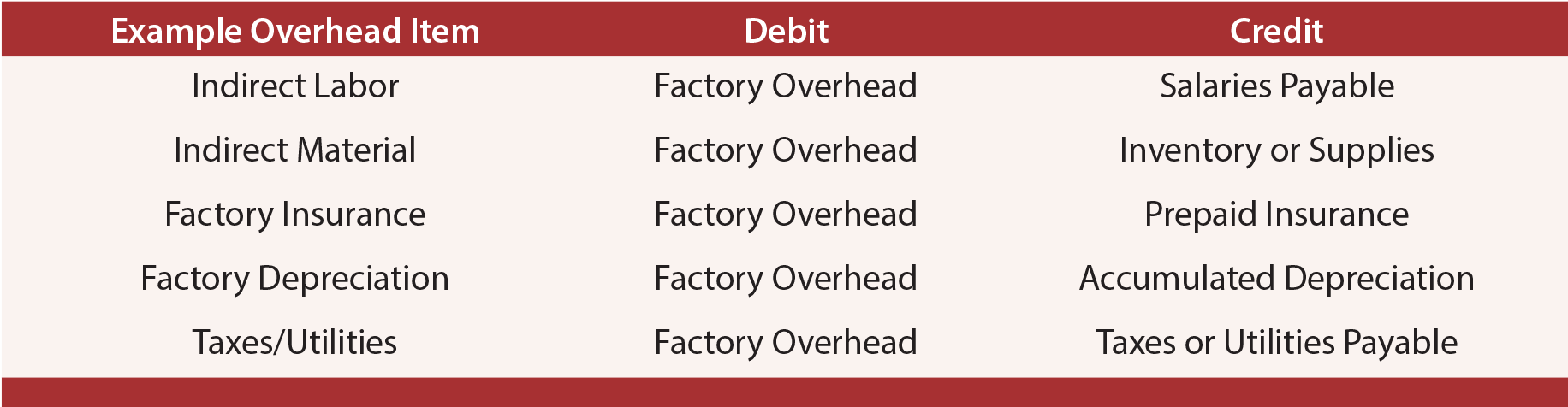

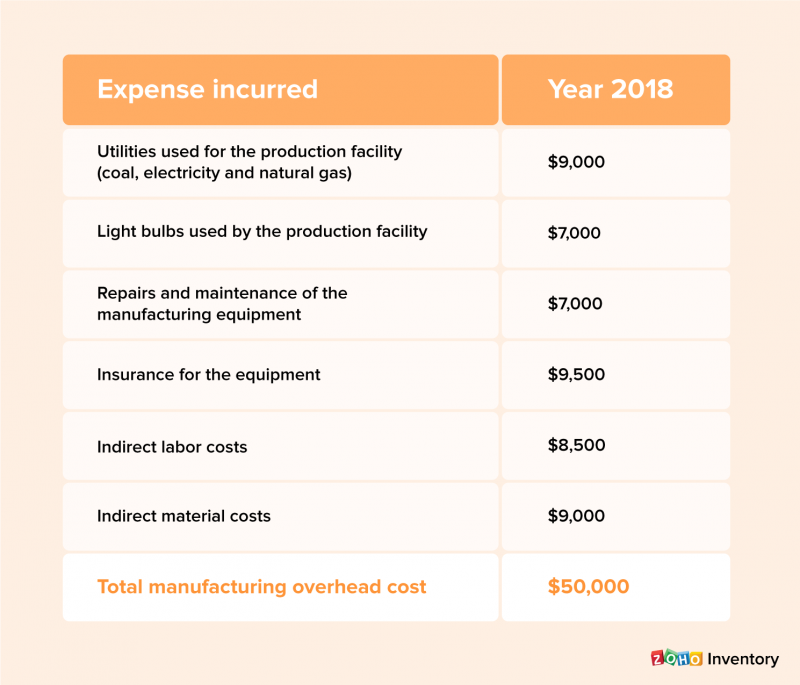

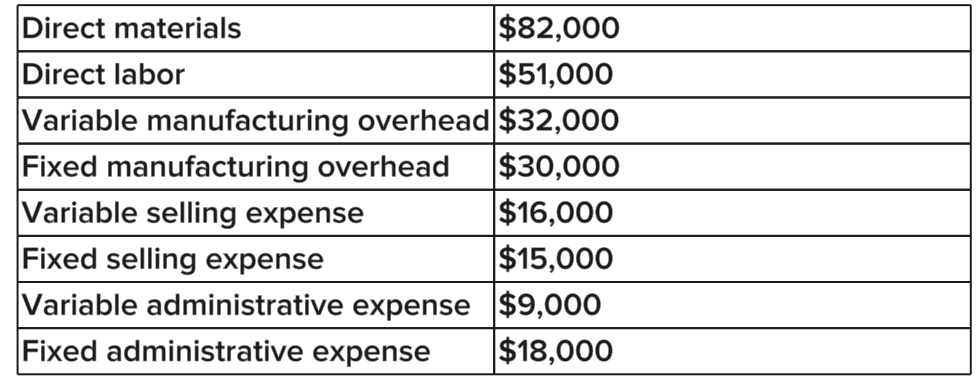

The company uses a job-order consisting system and computes a. Examples of costs that are included in the manufacturing overhead category are as follows.

How Is Process Costing Used To Track Production Costs

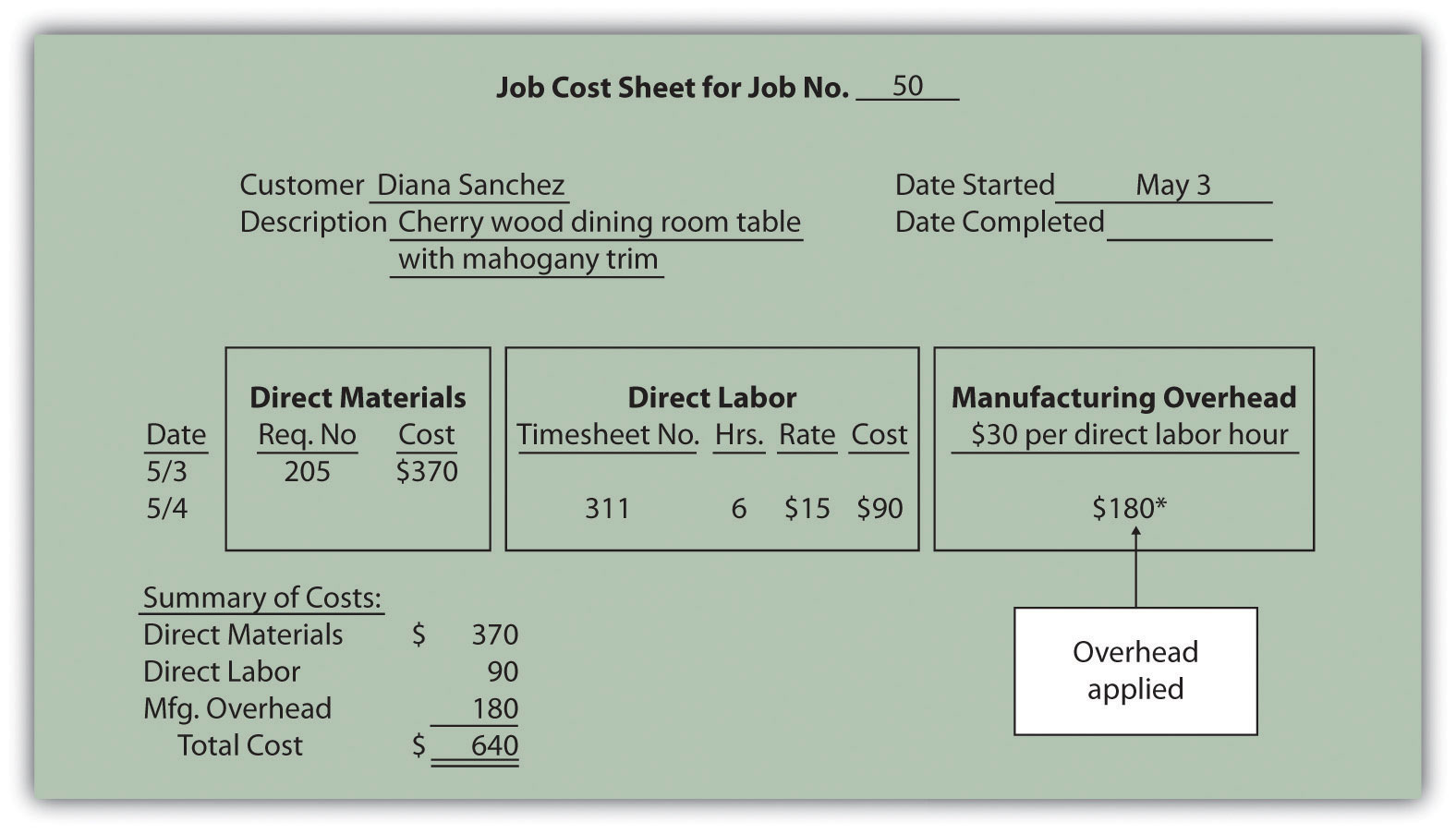

The manufacturing overhead cost assigned to the job is recorded on the job cost sheet of that particular job.

. The Manufacturing Overhead account. A the Cost of Goods Sold account B the Raw Materials account. The Cost of Goods Sold account.

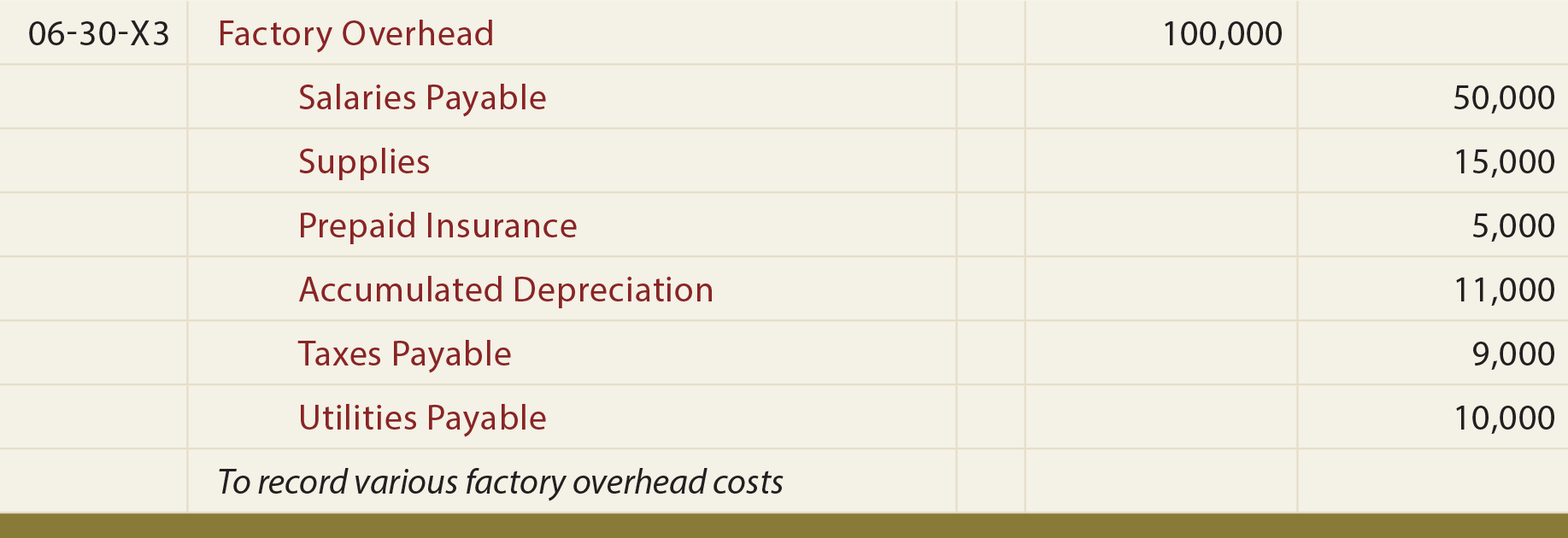

These are the manufacturing costs other than direct materials and direct laborThe actual overhead refers to the indirect manufacturing costs actually occurring and recorded. Actual Overhead costs are the true costs incurred and typically include things like indirect materials indirect labor factory supplies used factory insurance factory depreciation factory maintenance and repairs factory taxes etc. ASSIGNING MANUFACTURING OVERHEAD TO PRODUCTION IN GENERAL 1.

Definition of Applied Overhead. The manufacturing overhead cost would be applied to this job as follows. 110000 charged to specific jobs and.

APPLYING MANUFACTURING OVERHEAD COSTS A. The Raw Materials Inventory account. When a job is completed its costs are transferred into ___.

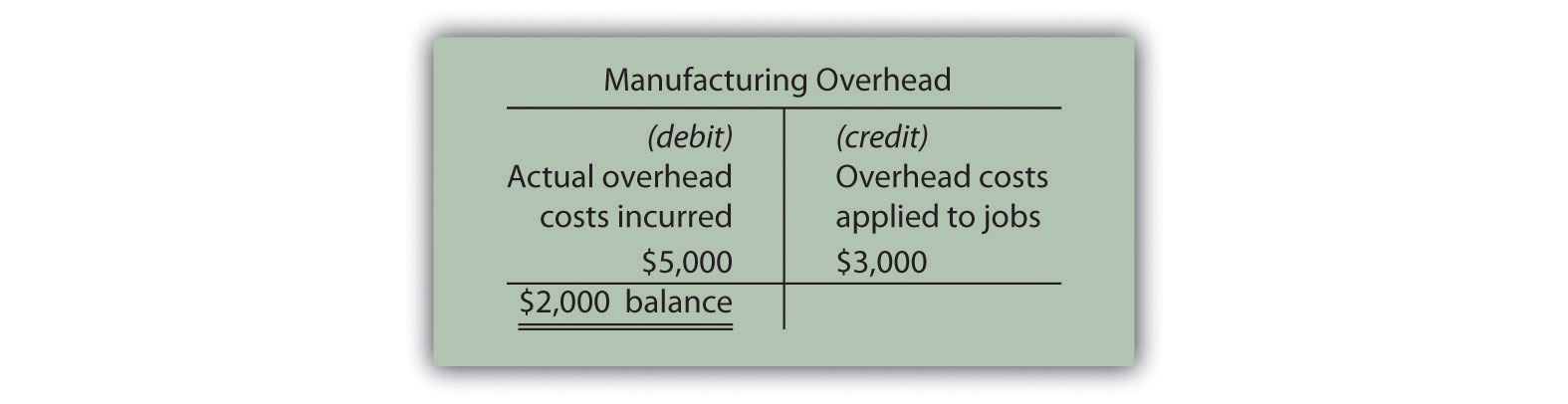

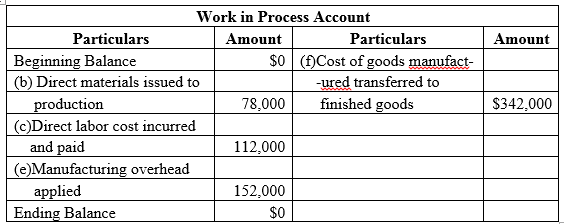

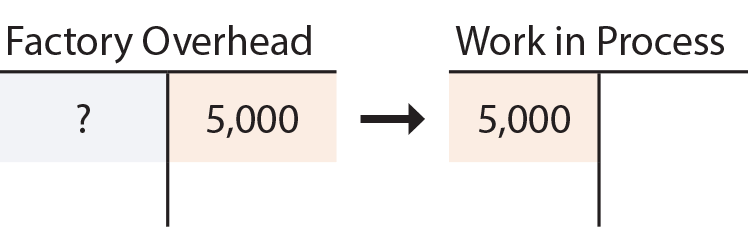

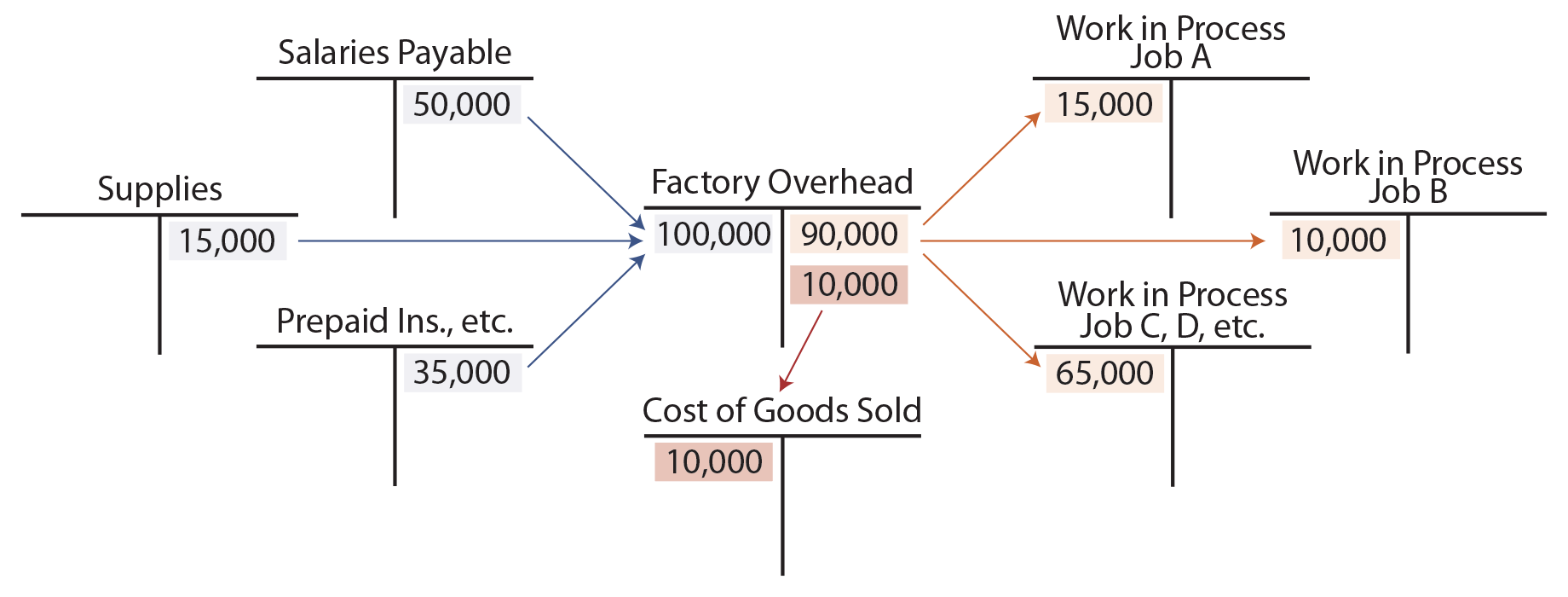

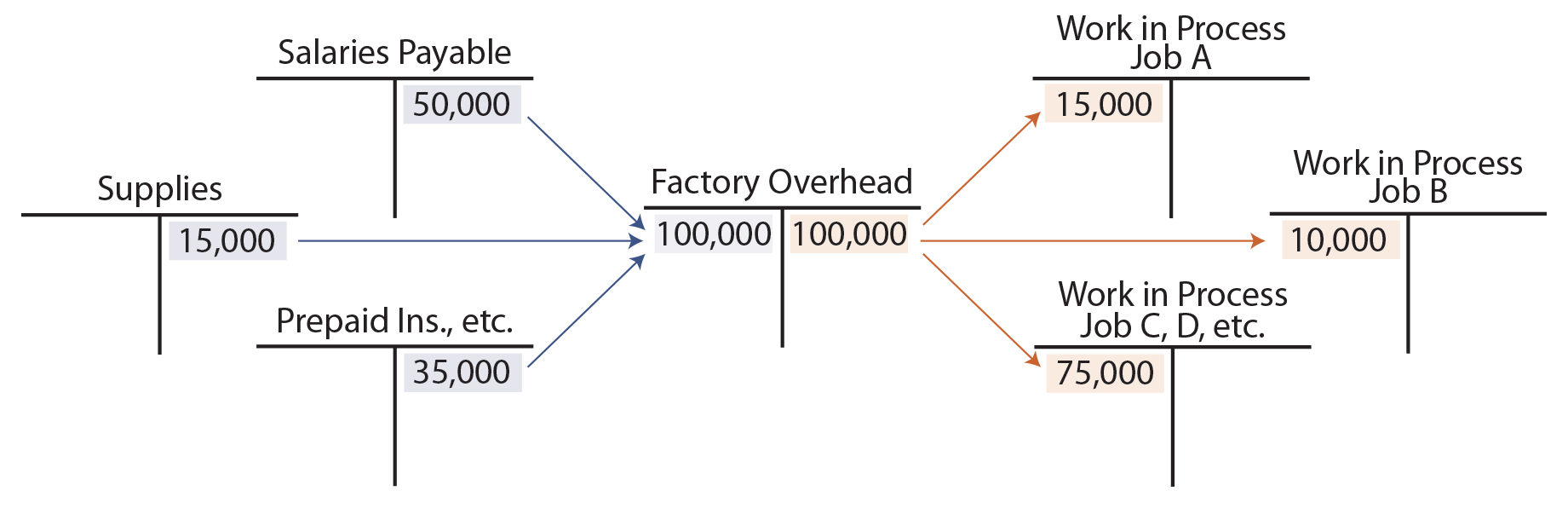

C the Work in Process account. The 1___ side of the manufacturing overhead MOH account is always used to record manufacturing overhead MOH applied to production and the 2___ side is always used to record the actual manufacturing costs incurred. The debit is always Work-in-progress Main Ideas in Chapter 15 SolutionPage 24.

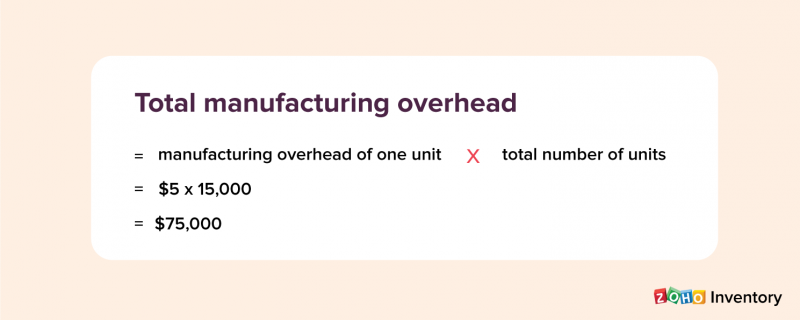

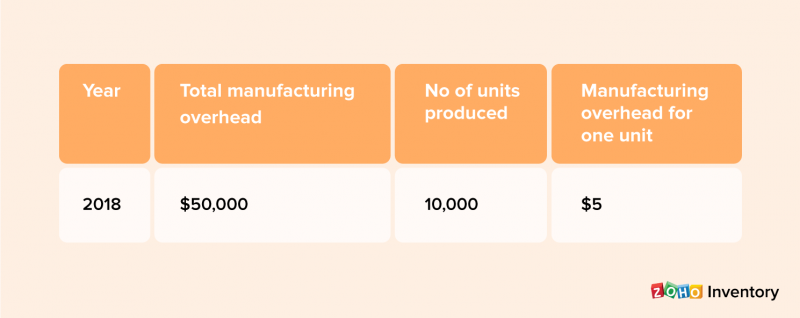

This means the budgeted amount is less than the amount the business actually spends on its operations. Overhead applied to a particular job Predetermined overhead rate Amount of the allocation base incurred by the job 800 27 DLH 216. Asked Aug 31 2019 in Business by alliemay A.

5 pounds at 900 per pound 4500 Direct labor. 3 hours at 8 per hour 2400 Total. In this case the manufacturing overhead is overapplied by 500 10000 9500 as the applied overhead cost is 500 more than the actual overhead cost that have occurred during the period.

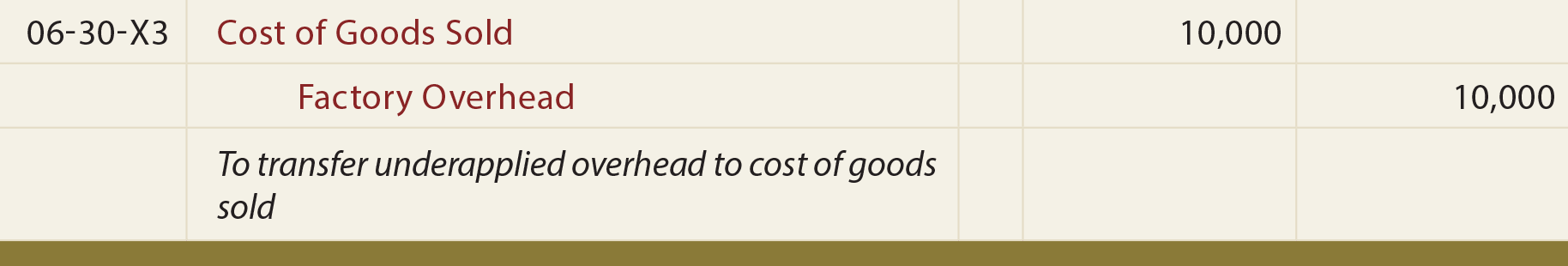

If variable manufacturing overhead is applied to production on the basis of direct laborhours and the direct labor efficiency variance is unfavorable will the variable overhead efficiency variance be favorable or unfavorable or could it be either. The next journal entry shows the reduction of cost of goods sold to offset the amount of overapplied overhead. After overhead application the Manufacturing Overhead account will have a Php 2000 credit balance.

Manufacturing overhead cost was applied to production. Rashid Javed Updated on. Jobs were sold on account to customers during the year for a total of 2827500.

Manufacturing overhead is applied at 80 of direct labor cost. This overhead is applied to the units produced within a reporting period. Applied overheads are the indirect cost that is directly linked to the production of goods but cannot be charged specifically to any of the cost objects.

These include the manufacturing costs of electricity gas water rent property tax production supervisors. In accounting overhead usually refers to the indirect manufacturing costs. N a process costing system when manufacturing overhead costs are applied to the cost of production they are debited to.

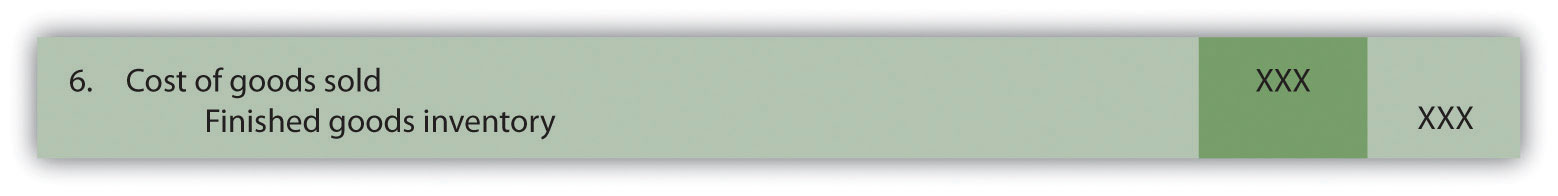

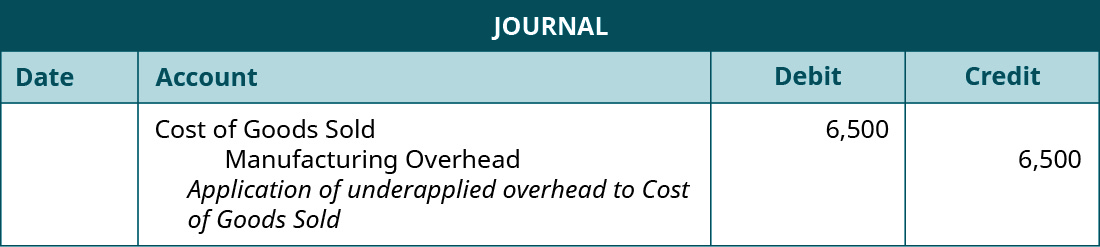

Underapplied overhead occurs when a business doesnt budget enough for its overhead costs. The Finished Goods Inventory account. Such overhead cost is charged or applied by the company to its various departments or cost objects at a specific rate.

These actual costs will be recorded in general ledger accounts as the costs are incurred. In a process costing system when manufacturing overhead costs are applied to the cost of production they are debited to. Applied overhead is the amount of the manufacturing overhead that is assigned to the goods produced.

Overhead costs are applied to jobs based on the activity the job consumed multiplied by the Predetermined overhead rate. If the manufacturing overhead cost applied to work in process is more than the. Up to 20 cash back D The overhead assigned to work in process is greater than the overhead incurred.

Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows. The Work in Process Inventory account. The Manufacturing Overhead account.

In most manufacturing organizations the applied overhead is added to the materials and direct labor to calculate the cost of goods sold on every job during a specified period. Depreciation on equipment used in the production process. Manufacturing overhead is all indirect costs incurred during the production process.

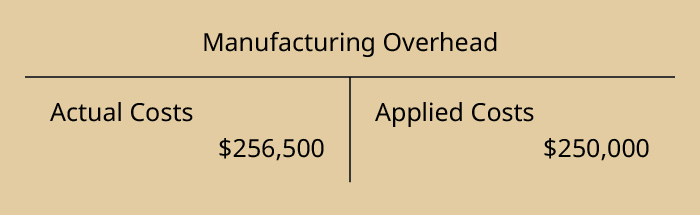

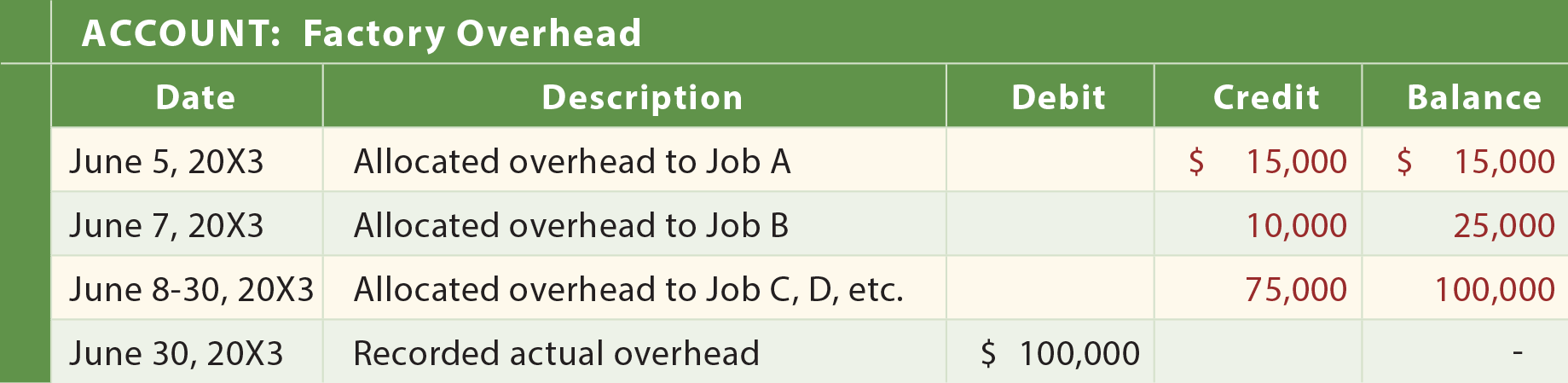

This is usually done by using a predetermined annual overhead rate. The over or under-applied manufacturing overhead is defined as the difference between manufacturing overhead cost applied to work in process and manufacturing overhead cost actually incurred by the entity during the period. Jobs costing 1403100 to manufacture according to their job cost sheets were completed during the year.

Actual overhead costs are any indirect costs related to completing the job or making a product. When manufacturing overhead is applied to production it is added to. 72 net operating income gross margin minus selling and administrative expenses.

3 hours at 14 per hour 4200 Variable overhead. Preble Company manufactures one product. Always keep in mind that the goal is to zero out the Factory Overhead account and measure the actual cost incurred.

While calculating the cost of goods sold for the period. B actual overhead costs were greater than overhead costs applied to jobs. Example of Applied Overhead.

Bassett Corporation has two production departments Milling and customizing. D the Finished Goods inventory account. At the same time accountants are also recording the actual bills.

In this last example 100000 was actually spent and accounted for. Property taxes on the production facility. They keep a running total of these costs and hold them aside for later.

The company actually worked 41000 direct labor-hours on all jobs during the year. The _____ side f the manufacturing overhead account is always used to record manufacturing overhead applied to production and the ____ side is always used to record the actual manufacturing costs incurred. However the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is 10000 for the period.

If the Manufacturing Overhead account has a debit balance at the end of a period it means that A actual overhead costs were less than overhead costs applied to jobs. Question 15 When the actual overhead costs incurred exceed the amount of overhead applied to jobs on a predetermined rate the Manufacturing Overhead account is said to be underapplied.

Assigning Manufacturing Overhead Costs To Jobs Accounting For Managers

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Determine And Dispose Of Underapplied Or Overapplied Overhead Principles Of Accounting Volume 2 Managerial Accounting

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Determine And Dispose Of Underapplied Or Overapplied Overhead Principles Of Accounting Volume 2 Managerial Accounting

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Solved Jurvin Enterprises Recorded The Following Transactions For Chegg Com

Assigning Manufacturing Overhead Costs To Jobs Accounting For Managers

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Assigning Manufacturing Overhead Costs To Jobs Accounting For Managers

Accounting For Actual And Applied Overhead Principlesofaccounting Com

How Is Job Costing Used To Track Production Costs

Accounting 2302 Final Exam Flashcards Chegg Com

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Comments

Post a Comment